If you are not a subscriber of The Crypto Intelligence Report, join other investors who get in-depth crypto content weekly, and other perks only subscribers get access to.

INTRODUCING THE SANDBOX

The French project The Sandbox was born in 2012. Initially available in two dimensions, the project migrated in 2017 to the Ethereum blockchain. It offers a decentralized ecosystem co-constructed by users of the metaverse. The platform allows users to create NFTs that can be used in the metaverse.

These NFTs can take two different forms:

Objects to be used in the metaverse game.

Plots of land on which the player can create mini games for example.

Note that these two types of NFT can be resold on NFT marketplace platforms such as OpenSea. In terms of market cap, The Sandbox project represents today the second metaverse project with a capitalization of 3.65 billion dollars. A capitalization that allows The Sandbox to be in the thirty-eighth position of the main crypto projects.

The SAND token, at the heart of The Sandbox project, is a governance token. This means that the owners of these tokens can have a say in the management of the project. The community of SAND token holders can vote for the different evolutions of the platform.

GROWTH NARRATIVE

Originally the sandbox game was developed on mobile by Onimatrix but the project quickly attracted investors and the first application was launched in 2012. At that time, the idea was already to create a digital universe with blocks.

Four years later, a V2 of the application is born, but an even bigger project is in preparation. Wanting to move into 3D Voxel and offer a more complete gaming experience, Sebastien Borget (the director of The Sandbox) then partnered with Animoca Brands in 2018. That's when The Sandbox adventure begins.

The Sandbox is not limited to one game. It is made up of many standalone games, environments, and other experiences.

The team has left the universe open so that creators and players can ultimately build, own, and monetize the metaverse. In other words, it disrupts existing game makers such as Minecraft and Roblox, by offering creators real ownership of their creations in the form of non-fungible tokens (NFTs).

“In today's gaming market, centralized ownership and control of user-generated content limit the rights and ownership of creators. Centralized control of the exchange of player-generated virtual goods prevents players from generating fair value for their creations. With The Sandbox, we aim to overcome these limitations while accelerating the adoption of blockchain to grow the market for blockchain-based games.”

INNOVATION

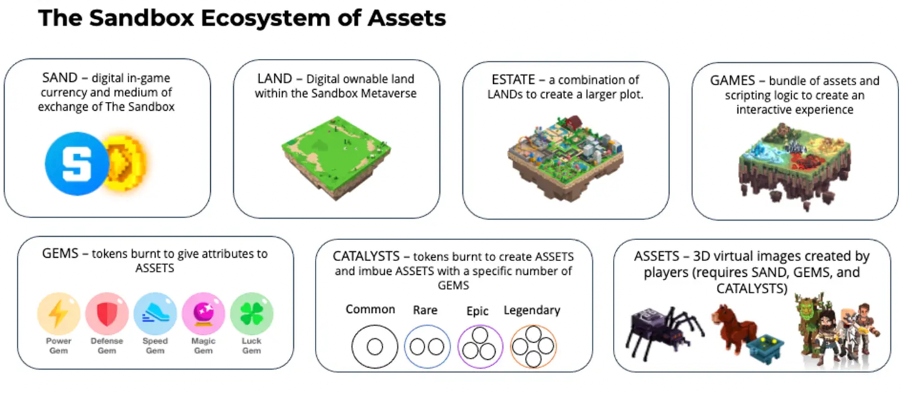

The Sandbox ecosystem leverages a variety of tokenized gaming features including:

SAND – a digital in-game currency used for purchases, monetization, and asset creation.

LAND – digital ownable land within the Sandbox virtual world.

ESTATE – a combination of LANDs to create a larger plot.

GAMES – a bundle of assets and scripting logic to create interactive experiences.

ASSETS – 3D virtual images created by players.

GEMS – tokens burnt to give attributes to assets.

CATALYSTS – tokens burnt to create ASSETS.

The Sandbox can be broken down into three sub-parts that together create a new gaming experience where the user produces and manages the content within it through:

A. VOXEDIT: A 3D voxel modeling software, for everyone, allowing people who have never coded to create and animate 3D objects such as people, animals, foliage, and tools without losing the performance of a professional paying software. They can then export them to The Sandbox marketplace to become game ASSETS.

B. MARKET: It is through this online marketplace that The SandBox users conduct their transactions. Here, their ASSETS are put on sale, they can download additional content, etc. Their creations (ASSETS) made in VoxEdit, are in the form of tokens (both ERC-721 and ERC-1155 tokens).

C. GAME MAKER: Owned ASSETS are useful when used in the Game Maker, or simply in the game itself. When launched in Game Maker mode, this ASSET can be used and placed in a piece of LAND (an ERC-721 token) that they can own in the virtual world. They are then free to decorate their FIELD with ASSETS and, more importantly, implement interesting and nuanced game mechanics by assigning ASSETS to players.

As explained, compared to classic videogames, The SandBox is using Blockchain technology to enhance user experience, giving them more power. The use of NFTs effectively allows users to have:

TRUE DIGITAL OWNERSHIP

The player holding an NFT is its true and sole owner and if the game closes or disappears, the player will still be the sole owner.SECURITY AND IMMUTABILITY

Usually, items in a video game based on rarity are subject to fraud and theft, but thanks to blockchain technology where everything is tracked and saved on a registry itself sent to thousands of machines, this risk is greatly reduced. Items can be tokenized and traded on primary and secondary markets managed and facilitated by blockchain technology.TRADING

Blockchain-based gaming platforms can provide users with ultimate control over their digital assets. They can buy and sell items freely without fear of being scammed or of a platform closing and voiding the entire value of their in-game items.CROSS-APP INTEROPERABILITY

The blockchain enables games to use shared assets. ASSETS, avatars, LANDS, and any other game elements can be used in other games that allow it. These game elements are no longer confined to a narrow digital ecosystem.

DISRUPTIVENESS

One of the main challenges facing voxel art creators in today's gaming environment is that they have limited or no rights to the intellectual property they create. This can lead to artists or creators spending days or even months creating their game worlds while receiving little to no financial benefit.

Another hurdle faced by gamers is establishing creative ownership of their work, especially if another gamer or entity copies, modifies, or builds upon the original work. Without a system to identify and track ownership of an item from the moment, it is created, it is nearly impossible to tell if the work is original or copied.

Finally, the current reliance on fiat currencies and credit card transactions means that credit card fraud is never far away. Currently, the ratio of illegitimate transactions in games can be as high as one in 7.5 items sold due to credit card fraud, which can disrupt the entire game economy.

By registering every asset created as an NFT, The Sandbox allows creators to have true ownership of everything they create. Creators retain copyright and ownership of everything they create and can sell and trade items while receiving all the benefits of their work. Because transactions are conducted via blockchain in Ethereum, credit card fraud is eliminated.

In addition to solving all of these problems, The Sandbox aims to bring even more value to creators’ handcrafted items. For the first time, creators will be able to see how their uploaded ASSETS come to life when they see them used in a FIELD in large experiments.

COMPETITION

Two large and ambitious projects are sharing a significant part of the market: The Sandbox and Decentraland. Two similar concepts, but with points of dissimilarity. We can’t say that Axie is a metaverse for the moment, therefore we don’t consider it as a competitor.

The Sandbox is a French project that was the first to go online since it was launched in 2012. Initially, it was still just a 2D mobile game. Until 2017, the migration to 3D was made on the Ethereum blockchain. A year after this major change, the famous game design company, Animoca Brands took ownership of The Sandbox. It then began to invest heavily in developing this metaverse.

Even though its competitor was first to market, that doesn't mean that Decentraland missed its launch. It was founded in 2015 and was quickly upgraded to a 3D version. The project was recently made available to the public but is already experiencing unprecedented success.

Both projects aim to develop virtual worlds based on the blockchain (Ethereum in this case). The metaverse allows users to create avatars, buy and sell digital assets such as virtual land and various game items while participating in the economy of each ecosystem.

Compared to Decentraland, The Sandbox has more lots in its metaverse with 166,000 plots. They are listed in two groups, namely estates and neighborhoods. It is important to note that in this project, it is possible to monetize a plot. You can rent it out or create games to earn it to do this. Decentraland has 90,601 plots of land.

These are classified into 4 groups namely:

Individual plots.

Estates are composed of multiple plots.

Neighborhoods are a group of parcels with similar themes.

Squares are plots belonging to the community and therefore not marketable.

Unlike its competitor, The Sandbox has a well-laid-out roadmap. Their biggest goal is to bring over 5,000 games to market by the end of 2023. A DAO is planned for Q2 2022, as is the introduction of concerts, a la Decentraland. The project has also included in its roadmap the creation of jobs in the metaverse to give members a chance to have a regular source of income.

On the other hand, The SandBox has taken the gamble of making numerous partnerships with brands and personalities, which has allowed it to quickly get the word out and catch the light of this new market.

However, let's keep in mind that this market is very recent and that the biggest potential players have not yet unveiled their projects.

We can mention in particular:

Meta of course, with its pharaonic project HORIZON WORLD (with also Horizon Venues for concerts and Horizon workroom for companies). Meta announced to invest more than 10 billion dollars and hire tens of thousands of developers.

Apple announced its intentions for world XR (mixed reality - between augmented reality and virtual reality) and its considerable financial capacities (nearly 200 billion in cash).

Microsoft which has a captive enterprise market and has just bought the video game studios Activision - Blizzard for 60 billion dollars

Google with its 6 billion searches per day! And which already has worldwide cartography (google earth, google maps, and google street view) which could be decisive in the race to the metaverse.

Tencent (Tencent QQ messaging with its 650 million active accounts, WeChat, SuperCell - clash royal & clash of clan), 40% shareholder of Epic Games

Epic Games (Fortnite and Unreal Engine the famous 3D engine) with a well-established ecosystem, 400 million active players, and fundraising of 1 billion dollars (including 200 million from Sony).

BiteDance (which owns TikTok).

Alibaba

And basically, all the digital giants.

EDGE ON THE MARKET

The Sandbox has experienced significant growth during 2021: it has over 500,000 registered wallets and 12,000 unique virtual LAND owners and has generated over $144 million in asset sales since its inception.

The Sandbox's creator economy is growing rapidly, creating new digital job categories such as NFTs creators, virtual architects, game creators, etc. To boost this economy, The Sandbox announced in November 2021 that it had secured $93 million in its Series B funding round led by SoftBank Vision Fund 2.

This metaverse also has the advantage of being, as we have seen, one of the first functional metaverses that is open to users without technical knowledge in coding or development. While similar to the Decentraland concept, The Sandbox is far ahead in terms of LAND plots, limited to 166,000.

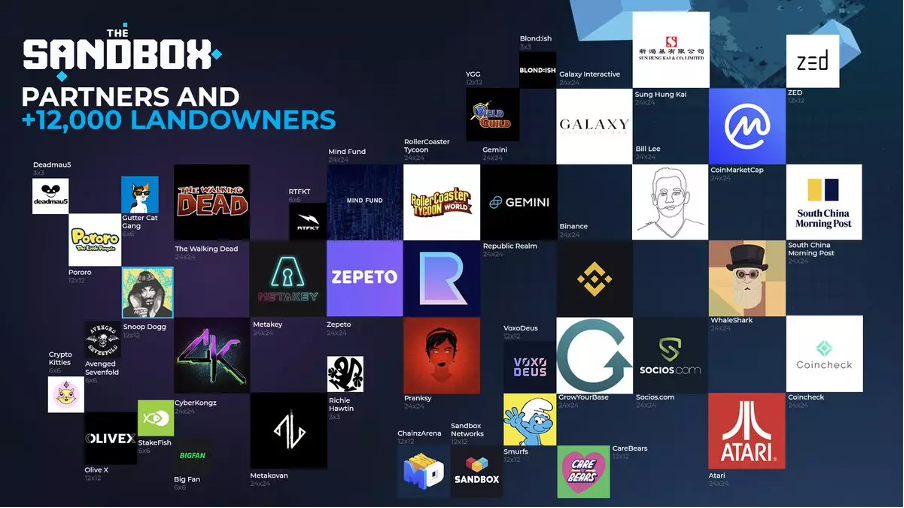

The Sandbox is therefore much more focused on the digital real estate concept and has a ton of interesting partners, including Deadmau5, Atari, and the developers of The Walking Dead games.

JP Morgan has predicted that the metaverse market could be worth $1 trillion a year over the next two years. Morgan Stanley is even more optimistic, saying in a note to investors that the metaverse could in the future be worth $8 trillion in China alone, although adoption may take "a long time" due to technological and regulatory hurdles.

To date, more than 165 brands and artists have partnered to create their virtual world in The Sandbox, including Snoop Dogg, The Walking Dead, Atari, The Smurfs, Deadmau5, and more, which gives The SandBox the status of a metaverse showcase, further widening the gap with other projects.

CONCERNS

Although The Sandbox is on an upward trajectory, its official roadmap does not include any major innovations until 2023, aside from the launch of DAO governance in 2022.

At the same time, more and more metaverse and GameFi projects are being launched, challenging early entrants like The Sandbox and Decentraland.

“Gaming is the most dynamic and exciting category in entertainment across all platforms today and will play a key role in the development of metaverse platforms”

Satya Nadella, chairman and CEO of Microsoft.

Microsoft has bought gaming giant Activision Blizzard for US$68.7 billion as part of its conquest of the emerging metaverse market.

Meta-verse development has become a priority for tech giants, so much so that social media titan Facebook, which has nearly $900 billion in revenue, has changed its name to "Meta" to focus on metaverse and clearly announced its objectives.

For 2022 there is no doubt that The SandBox will remain at the heart of the metaverse news, its Alpha was a huge success, and the community has given only good feedback.

However, as soon as the competition discussed above will appear, the project will have to adapt very quickly.

TEAM

OVERVIEW

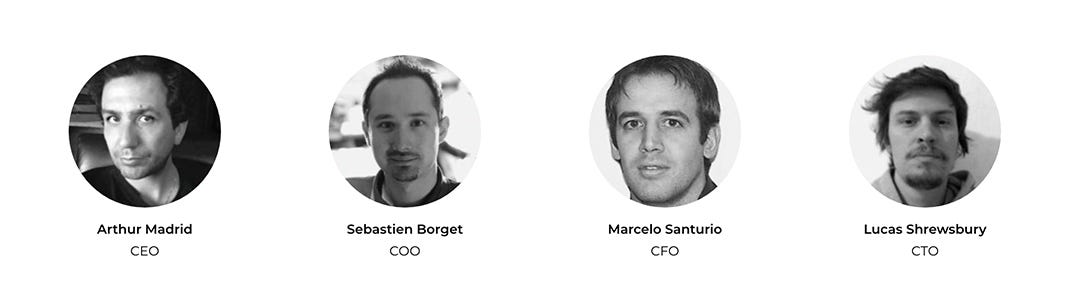

As we saw at the beginning of this article, The Sandbox was founded by two Frenchmen, Arthur Madrid, and Sebastien Borget. The Sandbox website shows that the team is scattered all over the world, and gathers more than 200 people.

TRACK RECORDS

Arthur Madrid - CEO and Director of The Sandbox Arthur Madrid is the Co-founder and CEO of Pixowl (acquired by Animoca Brands in 2018) as well as The Sandbox (40M players). Board Member of Animoca Brands and a longtime social gaming entrepreneur. He sold two software companies (Wixi Inc. and 1-Click Media) and is an advisor for startups in gaming, social media, and software. Arthur began his career building a P2P delivery platform for Media companies, one of the first Distributed Computing Software (DCIA) platforms. Now, he is focusing on Blockchain Gaming as CEO & Co-Founder of The Sandbox.

Sebastien Borget – COO and Director of The Sandbox Sébastien Borget is the Co-founder and COO of Pixowl (acquired by Animoca Brands in 2018) as well as The Sandbox (40M players). Passionate for blockchain technology, gaming, and education, he is a very active speaker and evangelist on the opportunity Non-Fungible Tokens brings to gaming. He is now building the metaverse with The Sandbox, which is empowering players through NFTs, enabling them to own, buy, sell and trade their 3D creations on their Marketplace and use them in their Game Maker. Sebastien also became President of the Blockchain Game Alliance in 2020.

Marcelo Santurio - CFO of The Sandbox Marcelo Santurio is the Co-founder of the 1st online payment company in Latam and has +20 years of experience in Finance, Tech, and Gaming. MBA from the London Business School with a focus on Finance and Execute Program at MIT in Entrepreneurship.

Pablo Iglesias - Inventor of The Sandbox Game Pablo Iglesias has over ten years of experience in researching and developing emergent procedural systems while leading teams of professionals through several successful games.

Lucas Shrewsbury - CTO of The Sandbox, ex-CTO of Gameloft Lucas Shrewbusyr has spent more than a decade leading mobile gaming studios. While at Gameloft Argentina, he managed the studio and a team of 200 people.

MANPOWER / PROJECT ADEQUATION

In addition to a team of 200 people deployed worldwide, the project is advised by various industry experts:

Hashed - Based in South Korea and San Francisco, Hashed has realized meaningful gains in the crypto-industry. Led by serial entrepreneurs and engineers, Hashed has expedited global Blockchain adoption through strategic investment and community building.

Mikhael Naayem - Mik Naayem is Chief Business Officer at Axiom Zen and CryptoKitties, the world’s most successful game built on blockchain technology and Axiom Zen’s first public blockchain project. Mik focuses on directing business strategy, growing partnerships, and evolving the company platform.

Yat Siu - Co-founder and CEO at Animoca Brands. He is a serial entrepreneur and angel investor. He is the CEO and founder of Outblaze (sold B2B business to IBM in 2009) and he has received recognition for his role as an entrepreneur focused on Internet and technology companies.

Alexis Bonte - Group COO of Stillfront Group, Co-founder and board member of eRepublik Labs. He is a co-founder and angel investor with a strong general management background and over 20 years of 360 degrees experience in all types of start-ups from early-stage to post-IPO.

Ed Fries - Ed Fries created his first video games for the Atari 800 in the early 1980s. He joined Microsoft in 1986 and spent the next ten years as one of the early developers of Excel and Word. He left the Office team to pursue his passion for interactive entertainment and created Microsoft Game Studios. Over the next eight years, he grew the team from 50 people to over 1200, published more than 100 games including more than a dozen million+ sellers, co-founded the Xbox project, and made Microsoft one of the leaders in the video game business.

PARTNERS & BACKERS

To date, more than 165 brands and artists have already partnered to create their virtual world in The Sandbox, including Snoop Dogg, The Walking Dead, Atari, The Smurfs, Deadmau5, and others. Among the French partners, the Casino and Carrefour groups have already invested in plots on The Sandbox, in anticipation of the development of their e-commerce platforms in Web 3.

Havas Group also entered the metaverse at the end of February. The company aims to offer brands an immersive experience. Using virtual and augmented reality technology, the company has created "Havas Village" in the metaverse.

Some of the top LAND owners present in The Sandbox include Binance, Bored Ape Yacht Club, CyberKongz, CoinMarketCap, Pranksy, GrowYourBase, MetaKey, Zepeto, Socios, the Winklevoss twins or Bill Lee of Craft Ventures.

In addition, The Sandbox has added the following luminaries to its advisory team: Guy Oseary, founder of management firm Maverick, whose clients include Madonna, U2, and Bored Ape Yacht Club; Nicholas Adler, director and brand curator of entertainment icon Snoop Dogg; Thomas Vu, former executive producer and head of franchise and creative at Riot Games; and Mathieu Nouzareth, co-founder of FreshPlanet and creator of SongPop.

HSBC announced a new partnership with the metaverse platform, which included the purchase of a virtual plot of LAND.

Through our partnership with The Sandbox we are making our foray into the metaverse, allowing us to create innovative brand experiences for new and existing customers, we're excited to be working with our sports partners, brand ambassadors, and Animoca Brands to co-create experiences that are educational, inclusive, and accessible.

Suresh Balaji, Chief marketing officer of HSBC's Asia-Pacific branch.

CONNECTIONS WITHIN THE CRYPTO SPACE

The Sandbox virtual world will move from Ethereum to Polygon, a layer 2 or rather sidechain of the Ethereum blockchain (ETH), in order to be able to accommodate more audiences on its platform. Ethereum, which is widely used and has reached its maximum capacity, has high fees and transaction times, thus limiting the possibilities. So, to address these issues, the development team decided to migrate to Polygon to avoid potential network congestion while still being able to ensure minimal transaction fees.

According to Sébastien Borget, co-founder of The Sandbox, the game can be offered to a wider audience once the migration is complete. Polygon, previously named MATIC (its token has kept this name) is a platform running under Polygon SDK and whose objective is to aggregate protocols from Ethereum on higher layers such as the Polygon network to make the ecosystem less "scattered". It works with the so-called Proof-of-Stake (PoS) method.

And as announced above, the giants of the field are also present in The SandBox, in particular Binance which bought plots to quote only them. The SandBox also managed to convince blockchain users with an almost flawless Alpha season 1, motivating people uninitiated in the Voxel style to participate.

CONNECTIONS WITHIN THE TARGETED SECTOR

If only 1% of Minecraft and Roblox users tried The Sandbox, nearly 2 million players would enter the metaverse. Regardless, the popularity of the metaverse and the value of its token SAND have grown significantly over the course of 2021, and many more announcements and developments are in the works.

Season 1 of The Sandbox Alpha took place in late 2021, and the experience was a real success. While the event was open to everyone, only holders of an exclusive Alpha Pass were able to access the Play-to-Earn aspect of the game. A total of 5,000 Alpha Passes were distributed for free to the community via Twitter and other contests. The Sandbox organizes a lot of contests, especially on its Discord, so we invite you to connect to it to not miss anything. If you were one of the lucky few to have won an Alpha 1 Pass through these contests, you could have made a nice profit, as these NFTs sold for up to 2.7 ETH on the secondary market, or a whopping $11,300 by the time Season 1 launched on November 29, 2021. The number of registered users in The Sandbox surpassed 2 million at the official launch of its second alpha season on March 3, 2022. The alpha version of season 1 had launched in late November 2021.

The Sandbox's user base has grown rather rapidly even though the project is still in its alpha phase, thanks in part to its many partners, including big names like Warner Music, The Walking Dead, Snoop Dogg, and Deadmau5. Users of The Sandbox can now explore different virtual experiences in the metaverse. Players can complete 200 quests in hopes of obtaining the NFT Alpha Pass, which offers its holder rewards of up to 1,000 SAND, or about $3,000 at the cryptocurrency's current price.

COMMUNITY

COMMUNICATION

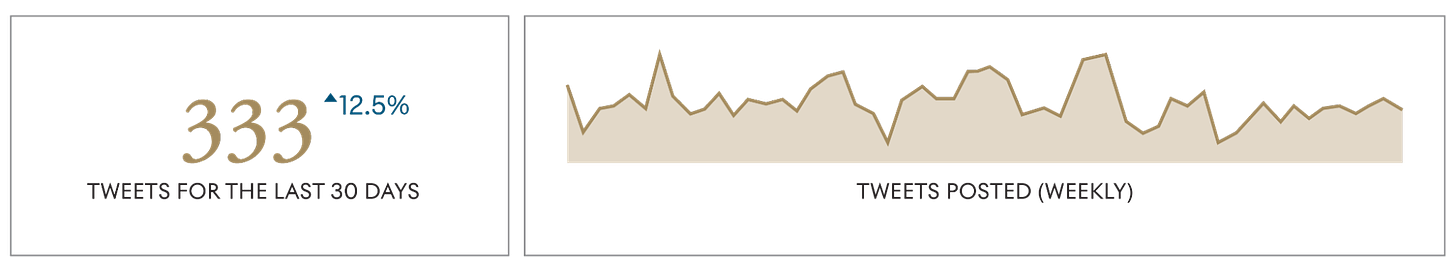

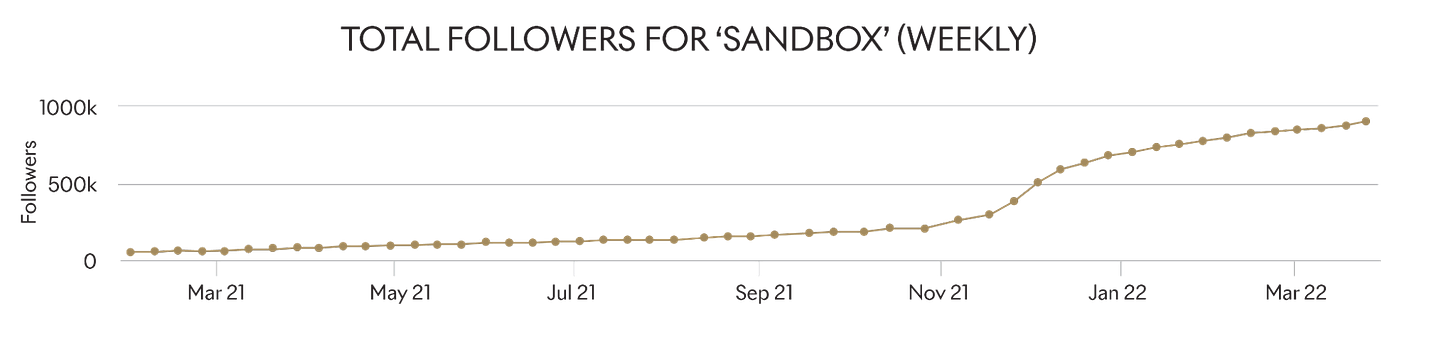

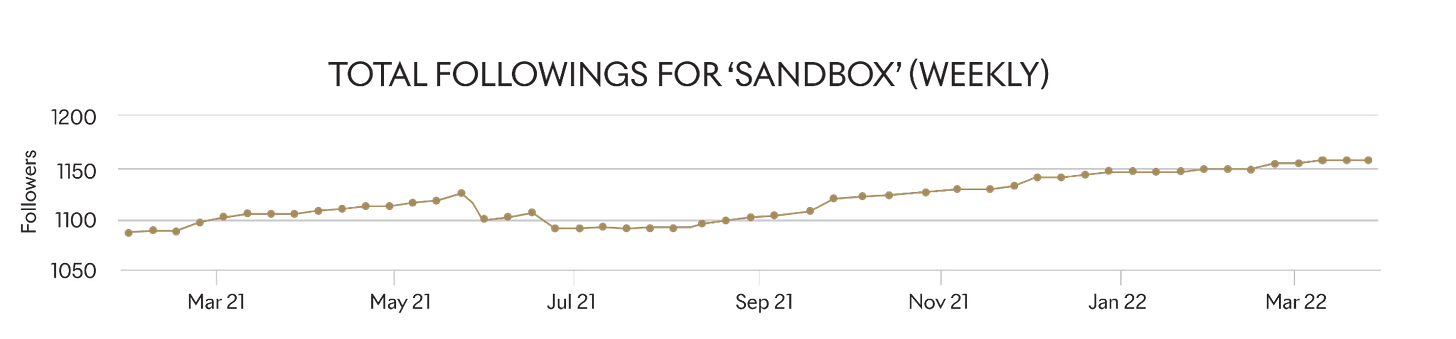

During the last month, The Sandbox has been very active on Twitter. The community is constantly updated on the progress of the team behind the project, by making AMAs on Twitter, video conferences on YouTube, giveaways as mentioned above, etc.

SIZE AND ENGAGEMENT

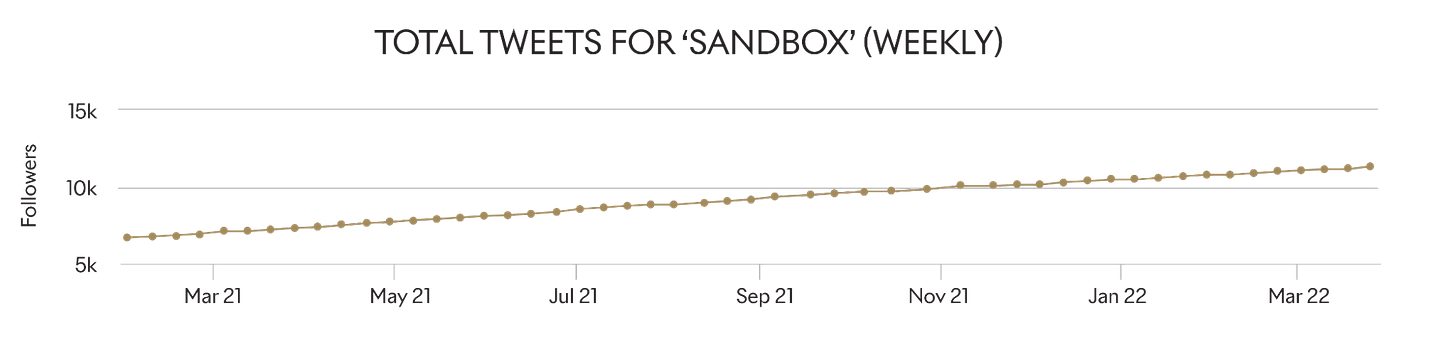

TOTAL FOLLOWERS, FOLLOWING, & TWEETS GAINED FOR THE SANDBOX GAME (WEEKLY)

PRICE

TOKEN RELEASE DATE

March 2020

PRODUCT RELEASE DATE

The SandBox Metaverse – Alpha 1.0 November 2021

MARKET CAPITALIZATION

Mar 25, 2022 – $3,981,819,871

ATL

Nov 04, 2020 - $0.02894

ATH

Nov 25, 2021 - $8.44

TA ANALYSIS

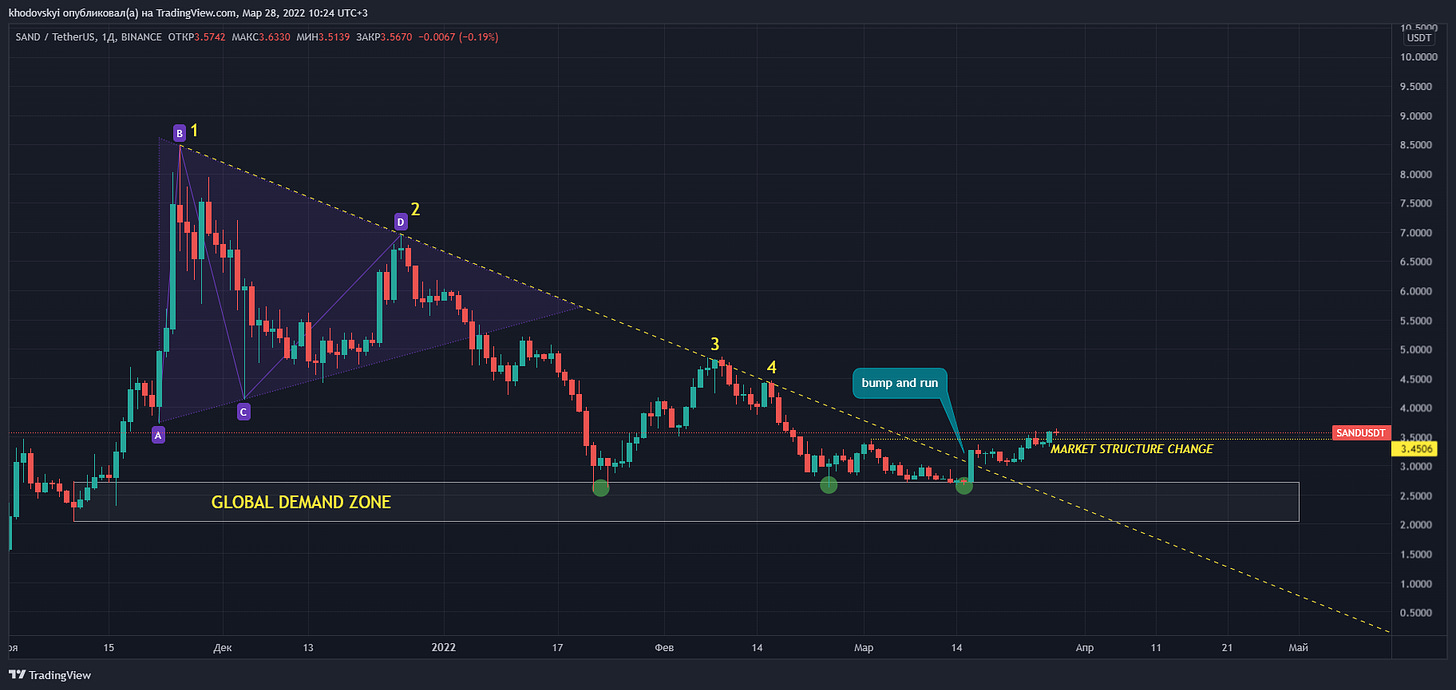

After the run-up from 0,70 cents, SAND has formed a triangular “distribution” phase, which was followed up by an expected downtrend along with the whole market. Coming down to the so-called “demand” zone, the asset showed a very strong reaction in a form of nearly 80% bounce, which not only proved the significance of that zone but also added one more important high (3) that secured the trend line 1-2. Given this price action, a larger triangle was formed with its base at the global demand zone and hypotenuse 1-2-3 and 4 (as additional confirmation).

The recent recovery of the market has helped SAND to finally come out of these boundaries, causing a market structure change and forming well known “bump and run” pattern, which is extremely bullish.

At the same time, the global demand zone has held for 3 touches in a row, but the more touches it has, the weaker it becomes. So, it is extremely important to understand, if this change in the structure doesn’t help SAND to go for a new leg up and the price comes back to this zone, it may not hold the next time.

However, this weakness can be used to our advantage as it helps us to realize where our stop loss should be put.

Now, let’s look into the volume perspective:

The last 6 months’ price action can be broken down into 3 ranges:

Distribution range (where the most significant part of long-accumulated SAND was sold by the MM)

Intermediate-range (highly volatile time, uncertainty in the market)

Accumulation phase (least volatile, clearly bound price action)

Measuring all these ranges with the horizontal volume profile tool gives us price levels, where most of the volume was traded within the ranges (so-called POCs). We can see, that the POC of the 1st range acted as significant resistance and formed an upper boundary for the 2nd range, as well as the 2nd range forming its own POC, which will most likely act as a resistance for recent price action.

However, the most interesting phase is happening right now, having the price coming out of a long accumulation phase, organically breaking its boundaries, with only one major minus - no significant volume, which could signify fake-out (trap) by a MM and the price may get accepted inside the range.

However, looking at the overall volume map of the last 6 months, it’s clearly seen that there is a volume gap, which should be taken fairly quickly if a breakout of the 3rd range is genuine.

Having all that at our disposal, we can form an interesting investing/trading idea that would remain fairly safe, given the fundamentals of the project:

As an investment, If SAND gets some volume injected, signifying a genuine breakout, even a “market price” buy can be in order, with the intention to buy in more at accumulation range POC to slightly DCA. While Intermediate-range POC and Distribution range POC can be the first two main targets + important horizontal levels (yellow) being the final targets (possibly leaving 10-15% moon-bag). This plan wouldn’t imply a stop loss.

For a dynamic trading idea, it would be wise to wait for a retest of accumulation range POC, which would give a better Risk/Reward ratio, with only two primary targets at Intermediate-range POC (50%) and Distribution Range POC (50%), stop loss set below global demand zone ~2,4$.

Markets

TOKENOMICS

TOKEN DISTRIBUTION

TOKEN RELEASE SCHEDULE

DISTRIBUTION, VESTING PERIODS, CIRCULATING SUPPLY

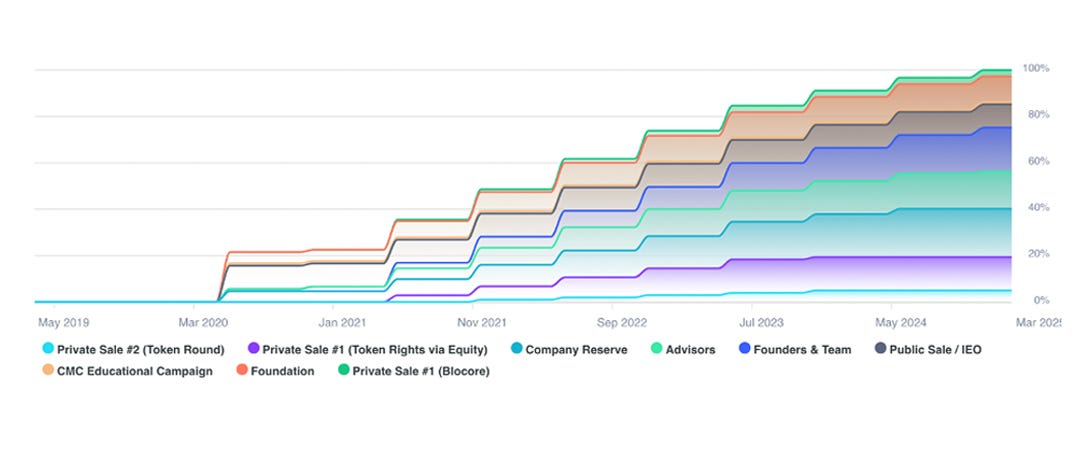

The SAND token has a maximum supply of 3,000,000,000 tokens, and is (or will be) distributed as follows:

Seed Sale (17.18%) equivalent to 515,277,777 tokens. This event happened in 2019.

Strategic Sale (4%) equivalent to 120,000,000 tokens.

Launchpad Sale (12%) equivalent to 360,000,000 tokens. This was the public sale of the token through the initial exchange offering (IEO).

Foundation (12%) equivalent to 360,000,000 tokens. The role of the Foundation is to support the ecosystem of The Sandbox, offering grants to incentivize high-quality content & game production on the platform.

Company Reserve (25.82%) equivalent to 774,722,223 tokens.

Founders & Team (19%) equivalent to 570,000,000 tokens.

Advisors (10%) equivalent to 300,000,000 tokens.

According to the whitepaper, these advisors are Hashed (blockchain company), Mikhael Naayem (Chief Business Officer of Cryptokitties), Yat Siu (Founder of different tech companies), Alexis Bonte (Founder of different tech companies), and Ed fries (Early developer of Excel and Word).

Tokens belonging to “Seed Sale”, “Founders & Team”, and “Advisors” are 100% locked with 5 years vesting and a 12-month cliff.

INCENTIVES TO HOLD

The main token of The Sandbox's virtual universe is the SAND, which is used to purchase other digital assets related to this metaverse. It is an ERC-20 token, which will also be used in the governance of the decentralized autonomous organization (DAO) that will be set up by The Sandbox in the near future.

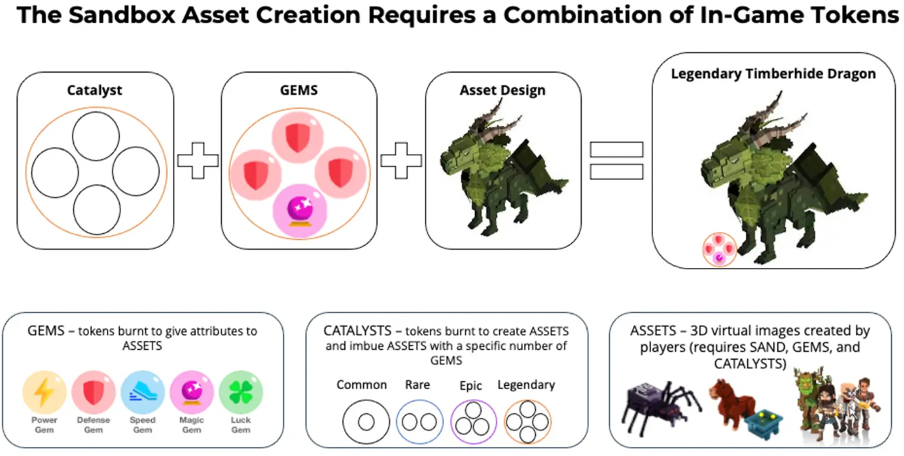

It is also possible to stake the SAND in order to earn passive income. This is the only way to obtain GEM and CATALYST tokens, both of which are used to enhance the specifics of the game's items, namely ASSETs, by adding attribute points to them at mint time

The usefulness of the SAND token is thus multiple:

Transactions: artists and players will exchange ASSETs for SAND. The SAND is also necessary to deposit the ASSETS on the market;

Governance: SAND will be the governance token for the DAO of The Sandbox. Holding this token will give you voting rights for the next developments of The Sandbox metaverse, but also concerning the use of the funds dedicated to the creators;

Staking: you can earn passive income by staking SAND on the platform. It is important to note that staking is the only way to farm GEMs and CATALYSTS, which are essential for the creation of ASSETS;

Fee Capture Model: 5% of the fees from The Sandbox marketplace will be used to strengthen the cash flow and the foundations;

Foundation: It collects funds that are used to develop the metaverse economy, offering grants to the most deserving artists and projects.

There will be a total offer of 3 billion SAND. At the time of writing (March 2022), approximately 1.089 billion SAND tokens are in circulation. All of them will be released during the year 2024.

Not financial advice. The Crypto Intelligence Report is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research and make an informed decision.

📺 Upcoming Webinars for Institutional Investors

Stratmont Brothers CIO and The Stratmont Intelligence Report publisher Gavin Cornelius is hosting an upcoming 55-minute webinar on crypto investing for family offices, wealth managers, and financial advisors covering our thoughts on crypto investing in 2022, our digital asset trading strategies to generate outsized consistent returns in all market conditions, and a macro overview of the current state and future developments of the crypto hedge fund ecosystem.

Register for free below.

Thu April 28, 2022 9:00 PM SINGAPORE / 2:00 PM LONDON / 9:00 AM NEW YORK - Crypto Investing For Institutions: Generating Outsized Returns

📺 Free Masterclass for Investors in 2022

In this exclusive Masterclass dedicated to forward-thinking investors, Stratmont Brothers’ trading fund Founders Kevin Loebler and Gavin Dantez help you understand the current tumultuous economic situation and walk you through the wealth opportunities hidden behind it. Register now for free below.

Here are the articles we’ve released so far:

Visit our channel:

Website at StratmontBrothers.com

Substack at Stratmontbrothers.substack.com

Masterclass at Stratmontbrothers.com/masterclass

Please share with your friends and colleagues.